Why Does Choosing an Account Matter?

The account you choose is important for your trading. It affects factors such as trading costs and how much you can potentially earn. Each Exness account has its own spreads, commissions, leverage options, and minimum deposit amounts.

For example, if you’re starting out, the Standard Cent account lets you trade with small amounts, limiting your risk. If you’re experienced, the Pro account gives you advanced features and tighter spreads. Choosing the right Exness account type is crucial. Consider factors such as your trading style, risk tolerance, and desired level of control when selecting an account that best aligns with your unique needs.

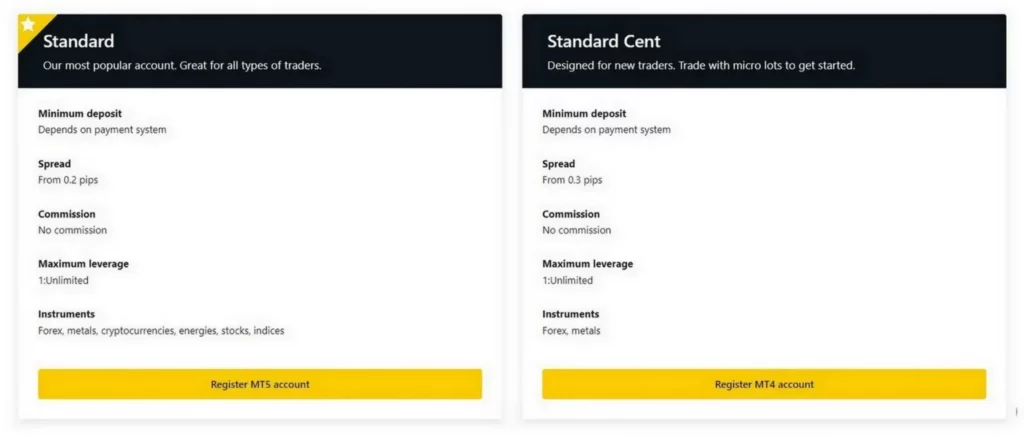

Exness Standard Accounts

Within the Exness Standard account category, there are two options: the Standard Account and the Standard Cent Account. Both accounts share similar features but cater to different trading preferences. The Standard Account operates with standard lot sizes, while the Standard Cent Account allows trading with micro-lots.

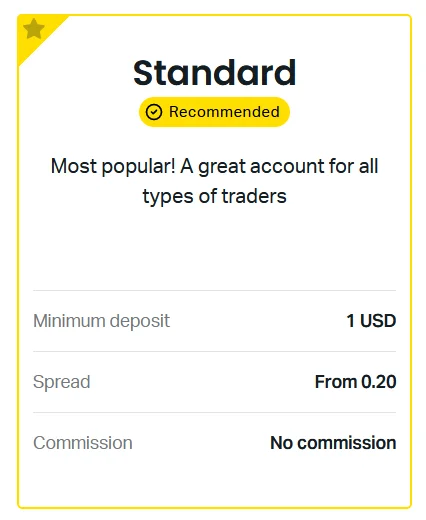

Exness Standard Account

The Standard Account is a good choice. It lets you trade major currency pairs, metals, and energies without paying any commissions. The spreads vary, starting at 0.3 pips. You can also use leverage up to 1:unlimited, which gives you flexibility in managing your positions.

| Feature | Standard Account |

| Minimum Deposit | $10 |

| Spreads | From 0.2 pips |

| Commission | None on major forex pairs, metals, and energies |

| Leverage | Up to 1:unlimited |

| Trading Instruments | Forex, Metals, Energies, Indices, Stocks, Cryptocurrencies |

| Order Types | Market, Limit, Stop, Stop-Limit, Trailing Stop |

| Scalping | Yes |

| Expert Advisors | Yes |

| Trading Platform | MetaTrader 4 and MetaTrader 5 |

| Mobile Trading | Yes |

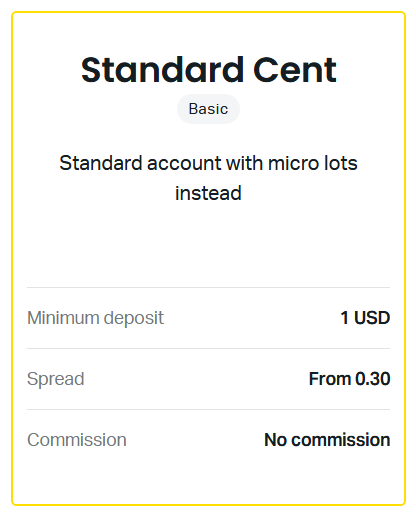

Exness Standard Cent Account

The Standard Cent Account is ideal for traders who prefer to start with smaller trade sizes. It allows trading with micro-lots (0.01 lot), reducing the potential risk associated with each trade. The spreads are slightly higher than the Standard Account, starting from 0.3 pips. Traders can leverage up to 1:unlimited.

| Feature | Standard Cent Account |

| Minimum Deposit | $10 |

| Spreads | From 0.3 pips |

| Commission | None on major forex pairs, metals |

| Leverage | Up to 1:unlimited |

| Trading Instruments | Forex, Metals |

| Order Types | Market, Limit, Stop, Stop-Limit, Trailing Stop |

| Scalping | Yes |

| Expert Advisors | Yes |

| Trading Platform | MetaTrader 4 |

| Mobile Trading | Yes |

| Minimum Trade Size | 0.01 lot (1000 units of base currency) |

| Maximum Trade Size | 100 lots |

The Standard Cent Account is particularly beneficial for beginners who are still learning and want to practice their strategies without risking significant capital. It also provides an opportunity for experienced traders to test new strategies or Expert Advisors in a live environment with minimal financi

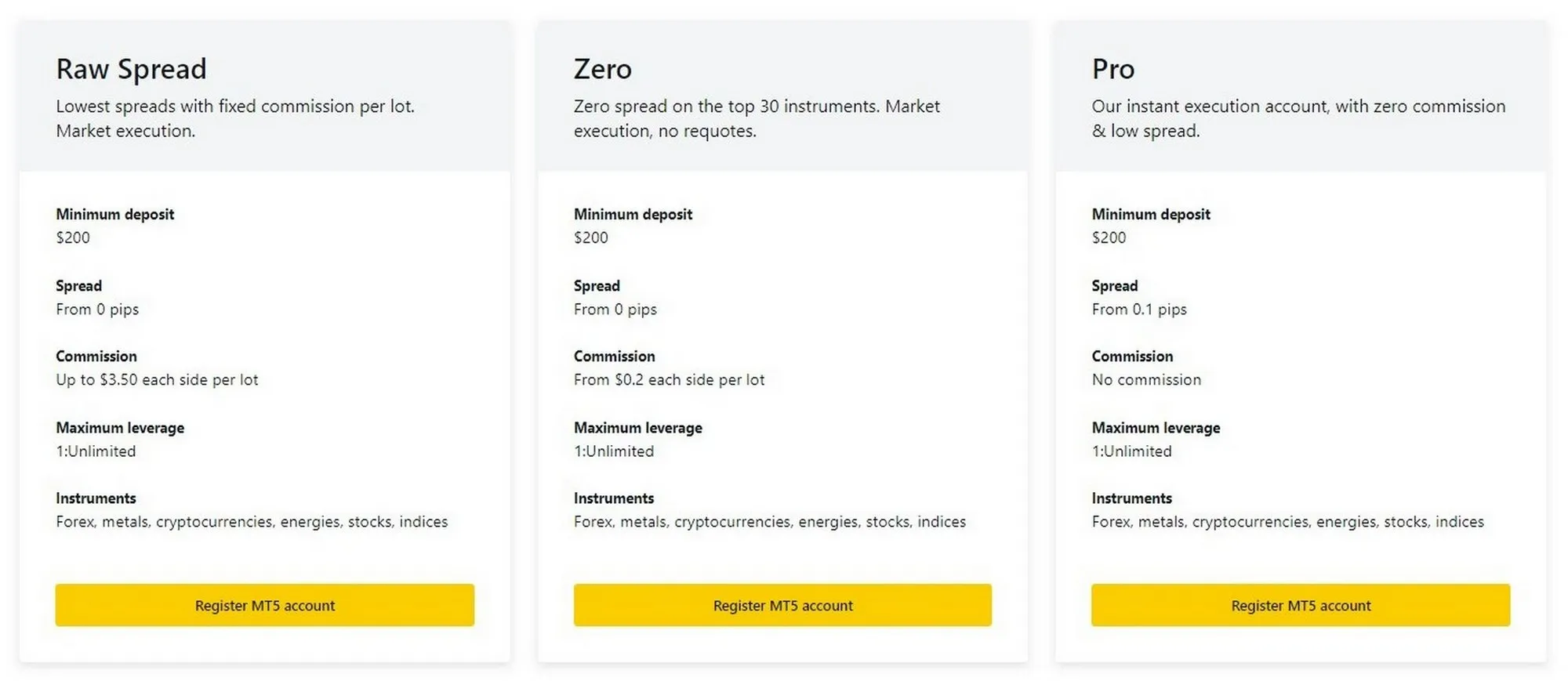

Professional Exness Accounts

Professional accounts are for experienced traders who want advanced features. These accounts often cost more to open, but they offer better spreads, lower commissions, and more tools to help you trade better. They are for traders who want fast execution, more markets to trade, and professional-level trading conditions.

There are three main professional account types: the Pro Account, Raw Spread Account, and Zero Spread Account. Each account is different and suits different trading needs.

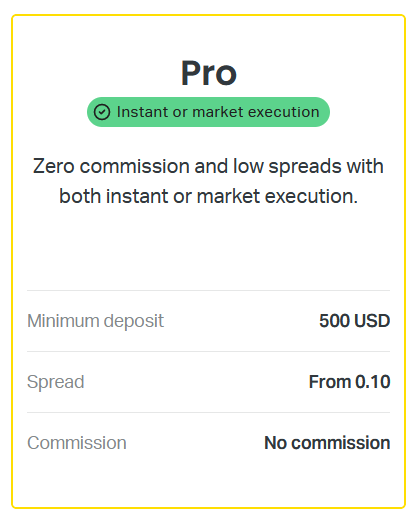

Exness Pro Account

The Pro Account offers a blend of raw spreads and commission-based pricing. It’s suitable for active traders who require tight spreads and fast execution. With a minimum deposit of $200, traders can access raw spreads from 0 pips and a commission of $3.5 per lot per side.

This account type offers superior execution quality and deep liquidity, making it ideal for high-volume traders and scalpers. The Pro Account provides access to all trading instruments, including forex, metals, energies, indices, stocks, and cryptocurrencies. Additionally, traders benefit from dedicated customer support and access to exclusive educational resources.

| Feature | Pro Account |

| Minimum Deposit | $200 |

| Spreads | From 0 pips |

| Commission | $3.5 per lot per side |

| Leverage | Up to 1:unlimited |

| Trading Instruments | Forex, Metals, Energies, Indices, Stocks, Cryptocurrencies |

| Order Types | Market, Limit, Stop, Stop-Limit, Trailing Stop |

| Scalping | Yes |

| Expert Advisors | Yes |

| Trading Platform | MetaTrader 4 and MetaTrader 5 |

| Mobile Trading | Yes |

The Pro Account’s combination of raw spreads, competitive commission, and advanced features makes it a compelling choice for traders seeking a professional trading environment.

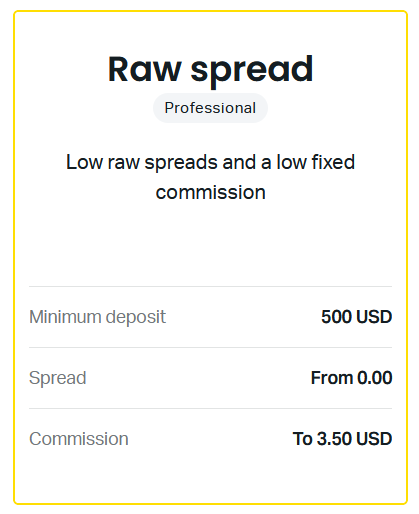

Raw Spread Account

The Raw Spread Account offers direct access to interbank market prices with minimal markups. Spreads start from 0 pips, and a commission of $3.5 per lot per side applies. This account is ideal for traders who prefer transparent pricing and want to benefit from the most competitive spreads available.

It is suitable for various trading styles, including scalping and high-frequency trading. The Raw Spread Account also provides access to all trading instruments, multiple order types, and advanced trading tools, ensuring traders have the resources they need to execute their strategies effectively.

| Feature | Raw Spread Account |

| Minimum Deposit | $200 |

| Spreads | From 0 pips |

| Commission | $3.5 per lot per side |

| Leverage | Up to 1:unlimited |

| Trading Instruments | Forex, Metals, Energies, Indices, Stocks, Cryptocurrencies |

| Order Types | Market, Limit, Stop, Stop-Limit, Trailing Stop |

| Scalping | Yes |

| Expert Advisors | Yes |

| Trading Platform | MetaTrader 4 and MetaTrader 5 |

| Mobile Trading | Yes |

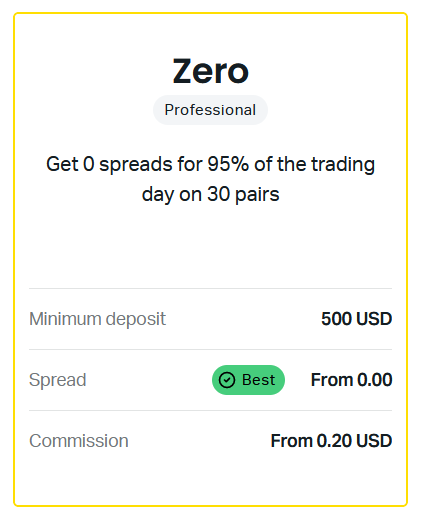

Zero Spread Account

The Zero Spread Account eliminates spreads on major currency pairs, providing traders with even more cost-effective trading conditions. However, a commission of $3.5 per lot per side applies. This account type is ideal for traders who prioritize low trading costs and want to avoid the impact of spreads on their trading results.

It’s suitable for various trading strategies, including news trading and swing trading. The Zero Spread Account also provides access to all trading instruments, multiple order types, and advanced trading tools.

| Feature | Zero Spread Account |

| Minimum Deposit | $200 |

| Spreads | 0 pips on major forex pairs |

| Commission | $3.5 per lot per side |

| Leverage | Up to 1:unlimited |

| Trading Instruments | Forex, Metals, Energies, Indices, Stocks, Cryptocurrencies |

| Order Types | Market, Limit, Stop, Stop-Limit, Trailing Stop |

| Scalping | Yes |

| Expert Advisors | Yes |

| Trading Platform | MetaTrader 4 and MetaTrader 5 |

| Mobile Trading | Yes |

Exness Islamic Account

For traders who follow Sharia law, Exness offers Islamic accounts. These accounts are swap-free, meaning no interest is charged or paid on overnight positions. This aligns with Islamic finance principles, making them suitable for Muslim traders. Islamic accounts are available for various account types, including Standard, Pro, Raw Spread, and Zero Spread.

Exness Demo Account

A demo account is a risk-free way to practice trading. It simulates a live trading environment, allowing you to explore the platform, test strategies, and gain confidence without risking any real money. The demo account comes pre-loaded with virtual funds, typically $10,000, which you can use to trade various instruments and experience market movements.

It’s an excellent tool for beginners to familiarize themselves with the trading platform, order execution, and different trading strategies. Even experienced traders can benefit from a demo account to test new strategies or Expert Advisors before implementing them in a live account.

Switching from Demo to Real Account

Transitioning to a live Exness account is easy. Open an account, verify your identity, and fund it. Remember, trading with real money involves risks. Have a plan and manage your risks before going live. Practice on the demo account until you’re confident.

Comparing Exness Account Types

Choosing the right account is crucial for your trading journey. Let’s break down the key differences to help you decide.

- Standard and Standard Cent accounts have a low $1 minimum deposit, while Professional accounts require $200.

- Standard accounts start at 0.2 pips, while Professional accounts offer raw spreads from 0 pips or even zero spreads on major pairs.

- Standard accounts have no commission on major forex pairs, while Professional accounts charge a commission per lot.

- Standard accounts are good for all traders, while Professional accounts are better for experienced traders who need advanced features and tighter spreads.

Which Account Is Best for You?

If you’re a beginner or prefer trading with smaller amounts, a Standard or Standard Cent account is a good starting point. These accounts let you explore the markets with low risk and minimum investment.

For experienced traders seeking a more professional trading environment with advanced features, tighter spreads, and faster execution, the Pro, Raw Spread, or Zero Spread accounts are better suited. These accounts cater to active traders, scalpers, and those who prioritize low trading costs.

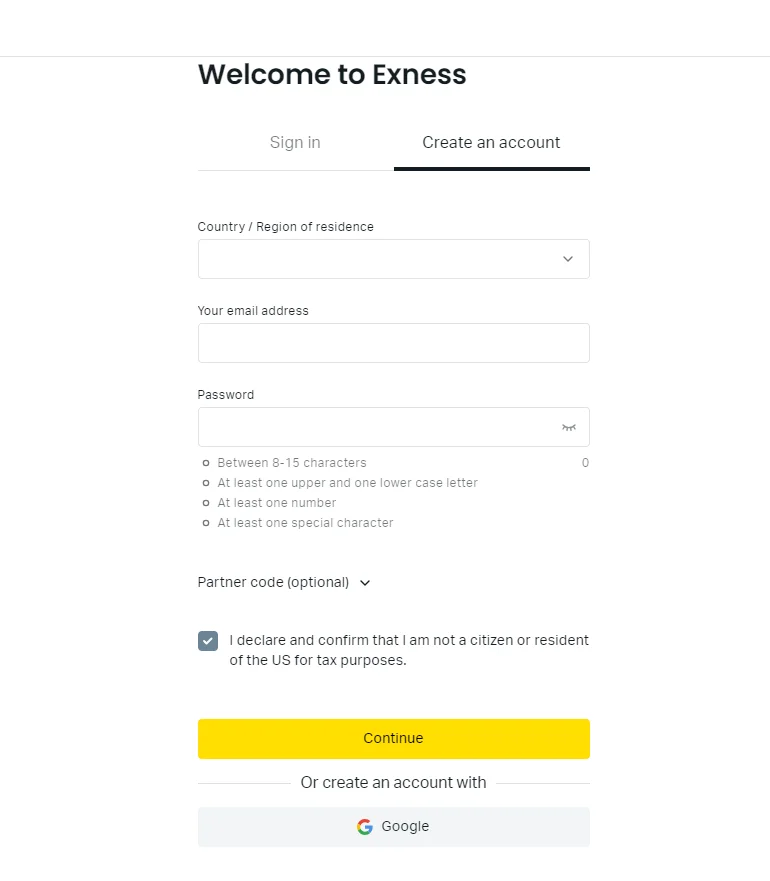

Exness Account Opening Process

Opening an account is straightforward.

- Go to the broker’s website exness.com.

- Click on any of the registration buttons.

- Fill in your details, including your country, email, and password.

- Click “Continue.”

- You’ll be in your personal area. Complete your profile and verify your identity with the necessary documents.

- Once verified, you can open a live Standard or Professional account.

- You can also use a demo account without verification.

- After opening a live account, make a minimum deposit and start trading.

Funding and Withdrawing from Exness Account

Exness supports various payment methods, including bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller. Deposits are usually instant, while withdrawals may take a few hours or days, depending on the method. The broker doesn’t charge deposit or withdrawal fees, but your payment provider might. Remember to check their terms.

Withdrawal requests are processed within 24 hours on business days. The minimum withdrawal amount varies depending on the payment method. Exness prioritizes the safety of your funds and uses secure technology to protect your transactions.

Frequently Asked Questions (FAQ)

What is the difference between Exness Standard and Standard Cent Accounts?

Both accounts offer similar features, but the key difference lies in the trade size. Standard Accounts use standard lot sizes (1 lot = 100,000 units), while Standard Cent Accounts use micro-lots (0.01 lot = 1,000 units). This makes the Cent Account suitable for beginners who want to trade with smaller amounts.